RGPT and How It Applies to You

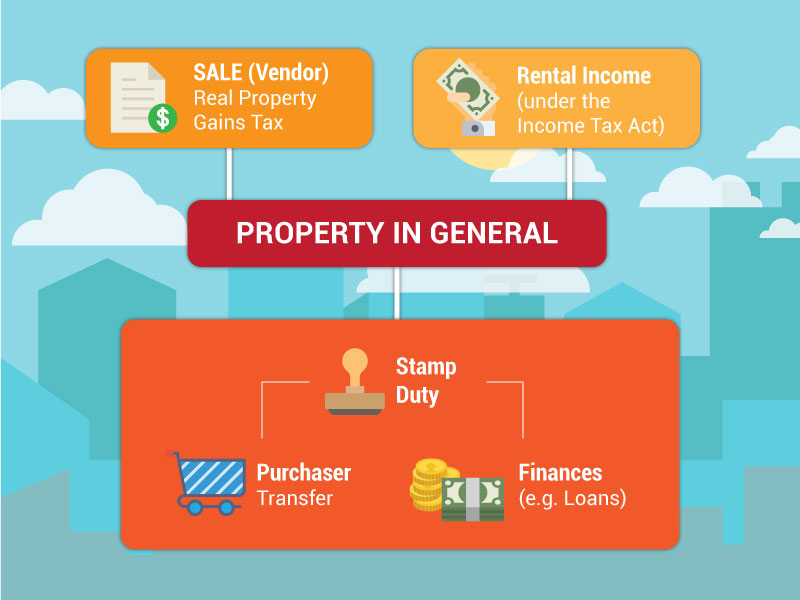

The Real Property Gains Tax (RPGT) is a form of Capital Gains tax (tax on profit from the sale of investments/property) on chargeable gains derived from property disposal. It is only applicable on positive net capital gains – when you make a profit for selling a property at a higher price.

For example, if you bought a property for RM200,000 and sold it for RM600,000, your RM400,000 profit would be taxed. However, in reality the calculations aren’t as simple.

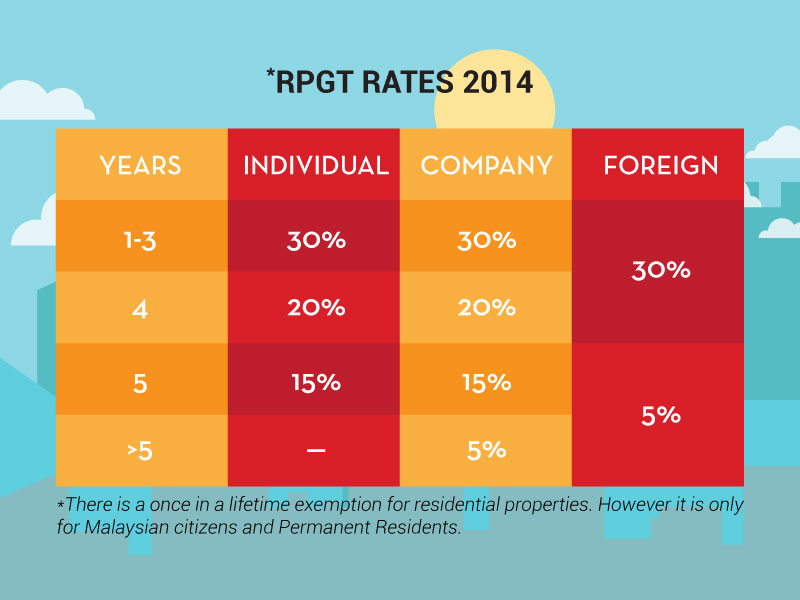

The latest Real Property Gains Tax rates were announced in the Budget 2014:

To calculate RGPT*, it is based on the profit you make from the sale of your property (net chargeable gains). The amount will require you to subtract expenses – such as real estate fees, legal fees, administrative fees, maintainence fees etc. – from your gross chargeable gains. Gross chargeable gains are essentially the price of acquisition (purchase) minus disposal (sale). The Real Property Gains Tax then applies based on how long you’ve owned the property x your net chargeable gains. If you’re interested, The Edge Property also has quick tips for a further read. [*source]

Real Gains Property Tax for transfers are as follows:

- 1% = The first RM100k

- 2% = For the next RM400k

- 3% = Anything exceeding RM400k

However for loans, it is RM5 for each RM1,000 or part thereof.

Post verified by Chee Hoe & Associates